The global sell off has continued and so have the discussions of global market slowdowns and corrections. Typically there are three frames of mind or trading styles that can occur in these volatile times. The important thing is to recognize when the market is providing the conditions for your style to thrive.

Charts Courtesy of Yahoo Finance

It is easy to think of market high and low extremes when presented with sharp downturns that seem steady like we have seen recently. The theme is either to get out of the way of an imminent market correction or to jump in and take advantage of bargains. This only allows for a limited thought process and trading style and it also limits the possible outcomes of an environment such as this one.

A more pragmatic and practical way to treat this market is to think of how your trading style lends itself to this market. Are you a day trader who can watch the market tick by tick? Are you a value investor who looks for buying opportunities during market panics? Are you a long term investor who ignores the news and doesn’t react unless something drastic about your investment choices has changed?

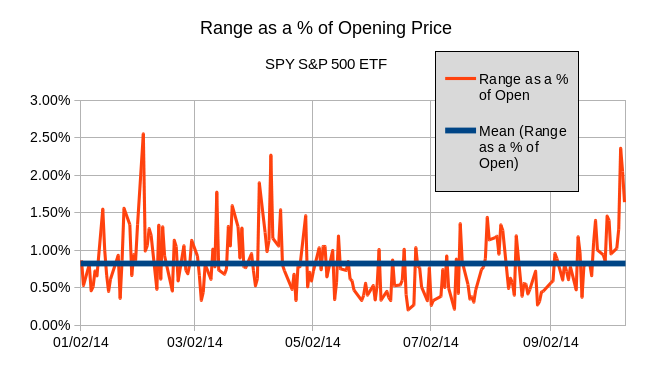

The answer to that question should guide you on how to react or not to react to this market environment. Day traders should be happy with the increased volatility. The trading range for the SPY, S&P 500 ETF is about 44% higher than average. That means that the range of the high of the day versus the low of the day has increased in comparison to the opening price. To put it another way there are larger daily price swings. With that kind of price action, traders who can get in and out of positions and profit from small price swings have ample opportunities to trade for profits. This type of trader usually has a disciplined system in place that limits losses quickly and can monitor the market minute by minute. Here is a graphic that tells the story that appeals to the day trader.

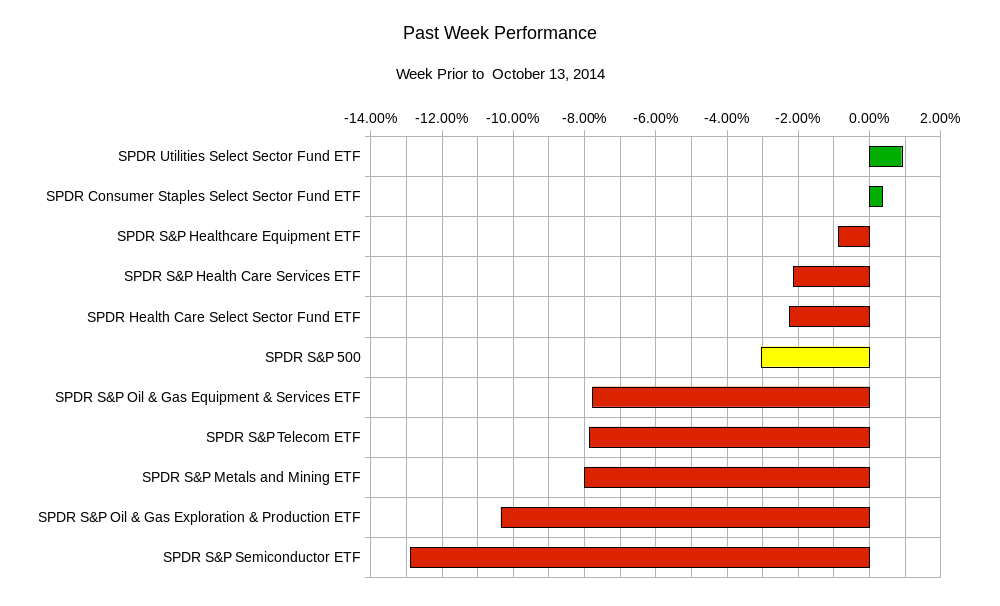

If you are a long term investor or value investor you are probably interested in how the recent market sell off has affected the various sectors of the equity market. It appears that the market has taken a turn for the more conservative side. Energy related stocks have been under pressure with the recent swoon in oil prices. At the same time conservative stalwarts such as the utilities and consumer staples sectors have actually been winning trades this past week. This continues to show some confidence in the markets by those who invest in less risky stocks. Perhaps they see this as the bargain opportunity to add stocks which typically pay consistent dividends to their portfolios. The fact that they have gains this week shows that there are investors who do not see this as a panic situation.

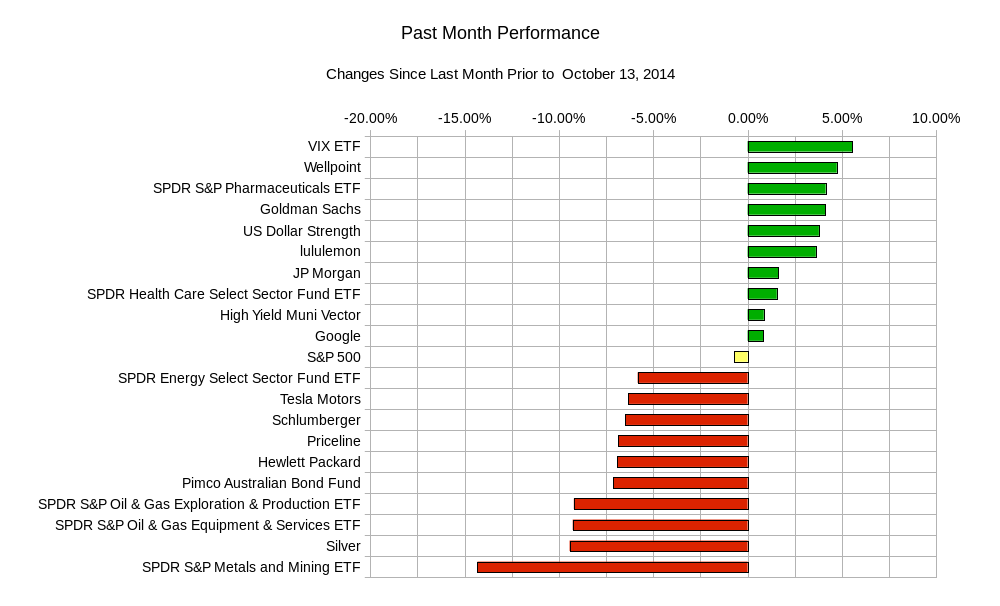

For those who have an even broader outlook, it is worthwhile to look at a broader set of market components over a period of the last month which includes the current market top.

For those who have an even broader outlook, it is worthwhile to look at a broader set of market components over a period of the last month which includes the current market top.

In this view, we see that there are gains in investments that encompass many different sectors. Despite the recent downturns there are still positive gains in a variety of asset classes. Health care and pharmaceuticals as highlighted by Wellpoint and related sector ETFs have performed rather well over the past month despite giving up some gains the past few days. Major financial firms such as Goldman Sachs and JP Morgan would have suffered more losses if there was a full blown market panic. In this past month they are still showing gains. The US Dollar and US High Yield (riskier) municipal bonds do not reflect a weakening outlook on the US economy. Even riskier equity names such as lululemon and google have shown stability over the longer time frame. On the other hand , the strength of the US dollar reflects a lack of faith in other currencies such as the Yen, and Euro. This speaks a bit to the relative lack of confidence in those economies as compared to that of the US. The weakness in commodities has hurt Australian bonds and its currencies as well.

In this view, we see that there are gains in investments that encompass many different sectors. Despite the recent downturns there are still positive gains in a variety of asset classes. Health care and pharmaceuticals as highlighted by Wellpoint and related sector ETFs have performed rather well over the past month despite giving up some gains the past few days. Major financial firms such as Goldman Sachs and JP Morgan would have suffered more losses if there was a full blown market panic. In this past month they are still showing gains. The US Dollar and US High Yield (riskier) municipal bonds do not reflect a weakening outlook on the US economy. Even riskier equity names such as lululemon and google have shown stability over the longer time frame. On the other hand , the strength of the US dollar reflects a lack of faith in other currencies such as the Yen, and Euro. This speaks a bit to the relative lack of confidence in those economies as compared to that of the US. The weakness in commodities has hurt Australian bonds and its currencies as well.

The point is that any story can be told from the same picture. Any picture can be made from the same story.

In times like these it is more important to recognize when your trading strategy has the highest probability of success and when it doesn’t. Play the game only when you like the rules.

Good luck and trade rationally.