Last week the markets were not as interesting as the US College Basketball tournament known as March Madness. Will this week be any different?

Again the market closed the week on a down note for equities. The morning session saw some buying action. The highs of the day were then quickly rejected and a long afternoon ensued with steady selling into the close. This seems to agree with the behaviour predicted in the comments from last week. The morning session rally may have come from derivative traders with leftover positions, purchasing “newer” contracts, or replacing contracts that were set to expire. Then once this mandated buying was over there were no more buyers left. Again, as mentioned earlier in the week, there are outstanding circumstances as to why traders may be hesitant to be long equities throughout the weekend. The fear that the Russian annexation of Crimea could lead to a larger conflict or that sanctions would incur retaliation of some sort is one excuse for keeping the market in check. The other, again, is the lack of enthusiasm in breaking out far above the intra-day highs the S&P 500 has been establishing the past few weeks. Traders may be waiting for discounts, even smaller ones, and are showing much more patience than exuberance. For now, the market seems content with its current path.

The economic data this week is on the lighter side. From the US side: Tuesday brings New Home Sales; Wednesday has Durable Goods Orders; The US Q4 GDP revision is announced along with the Weekly Jobless Claims on Thursday; Personal Income and Outlays will be released on Friday.

Perhaps more interesting will be data from outside the US where highlights include: Euro-zone Composite PMI (Purchasing Managers Index) on Monday; UK Consumer Price Index on Tuesday; Germany Consumer Confidence on Wednesday; Japan Consumer Price Index on Thursday; Germany Consumer Price Index and UK Q4 GDP results on Friday. With a European Central Bank monetary policy meeting set to happen on April 3, the European inflation measures will be in focus.

The British Pound seems to be a currency that has the potential for some movement.

Currently the currency is suffering from a five day losing streak that finds it resting on the 90 day moving average. The last few times this currency drifted downwards to this level it has met support and quickly rebounded. It is possible this can happen again, or perhaps it is a breakdown towards the downside. Regardless of your conclusion, it is likely the currency will move away from this trend line. Take a look at the FXB ETF which mirrors the currency.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

In a typical week this ETF may end the week between USD$161.70 and USD$164.60.

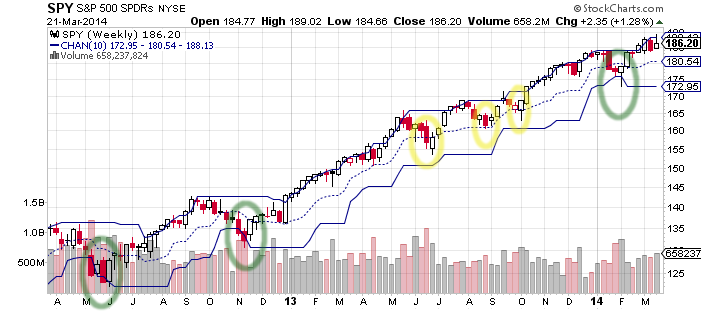

For the S&P 500 ETF, the SPY, the long term upward trend is hard to deny. Looking at a chart of weekly changes, with price channels that display the highs and lows for the previous ten weeks superimposed, you can see that the ETF has been and remains on a positive trend. The green areas show when the SPY has reached the lows of the channel, the yellow areas are when it reached the average level. Both instances show that it reacts sharply to the upside when faced with the green and yellow “decision” areas. This makes it very difficult to play any game involving the downside. Take a look at the chart below.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

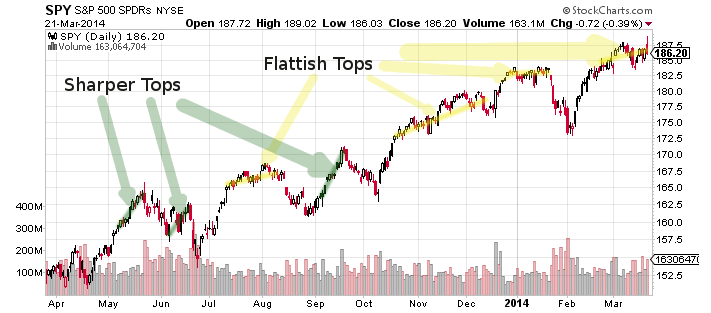

This does not mean that it is impossible to play the ETF to the short side. It means that great care is to be taken if you choose that path. The S&P 500 seems poised to keep investors on their toes and to frustrate all those who expect large swings. Looking at the daily chart below we see that sharper peaks were prevalent in the past and the peaks now are harder to define (or flatter).

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

This can lead to frustration as trading action may not be sufficient enough to give investors the confirmation that they have made the right decision. This is the type of frustration one might encounter in sideways trading. Fall asleep behind the wheel of a short position and you might end up in a panic. Wait too long for your long position to maximize the profit potential you had envisioned and you could let precious time and profits slip away in the event of a sudden crash. The SPY ETF is likely to end the week in between $182.40 and $190.10.

Keep in mind that your time is money and the reverse is true. Therefore always think about how long do you want to be exposed in a trade. If you wait too long to take profits you might end up with a nasty surprise.

Good luck and trade rationally.