Markets are at or near all time highs. Traders and investors looking to hedge or take profits. The usual headlines would lead you to believe that something dramatic should happen.

Charts Courtesy of Yahoo Finance.

Another week into earnings season and markets have shown their resilience. With pleasant surprises in most earnings reports there are numerous reasons to be bullish and of course there is a stream of data that would suggest an eventual correction. What might be more probable is that neither argument really gets to claim victory.

In the backdrop of continuing drama of how the new Greek government is going to address its financial situation along with weaker than expected US data, the markets have continued to march through April on a high note. Bearish traders will point to more and more put options or “insurance” trades being put on as signs of the impending doom of the bullish trend. However, keep in mind that insurance trades or bets are a rational and prudent action taken by those who are rational game players.

So the argument can be made that neither party, bull or bear, wants to place a lot of capital into their respective investment theories. This could be evidenced if the week shows light volume or if price movements are small. The actual money flow into and out of investments needs to prove that one of the trends has taken a foothold.

The week will bring some important earnings reports from the worlds largest company in Apple, as well as oil related stocks which should give more insight into the effect of depressed oil prices. Also, central bank policy of the US will be in focus in the middle of the week. While there is little expectation of a change in the US FOMC policy, there certainly is expectation that the recent string of weaker than expected will keep the looming interest rate hikes at bay. This mindset makes the next US monthly employment report more important to market volatility. Traders will likely look for some sign that the US economy is not stagnating.

Apple will report earnings after the close today. Currently if the price holds at USD$133 :

On average expect it to close between $128.40 and $137.80 by the end of the week. If it goes according to the average, expect a $7.20 move in either direction by the end of the week. Out of the past 18 times it has gone down in price 7 times. If the largest change (up or down) over the past 18 earnings reports is repeated, expect a move more to the tune of $20.70 in either direction.

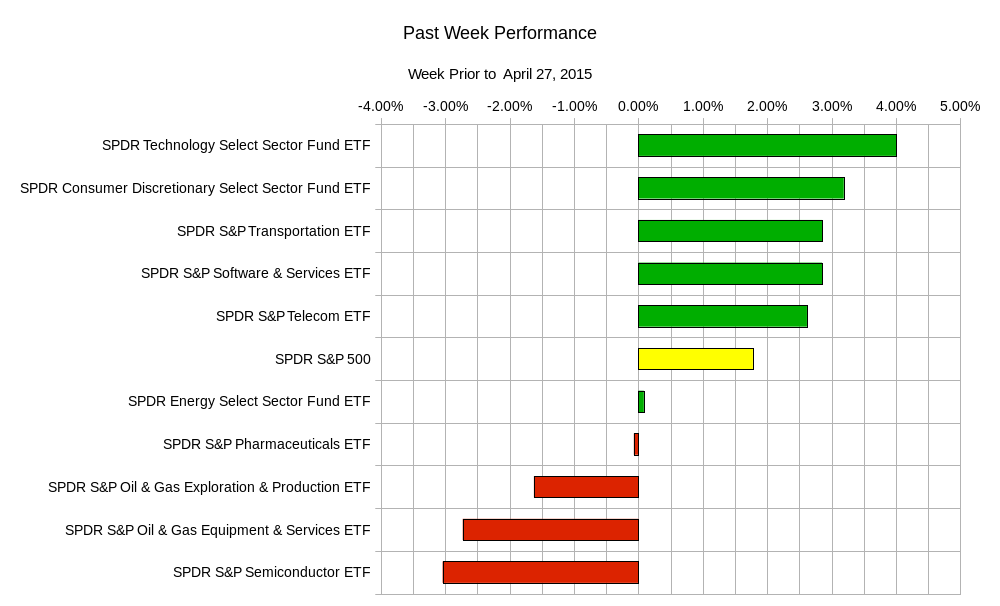

The past weeks performance shows more of the same rotation into names that have shown strong earnings. Let’s see if Apple, et al continue the trend.

In terms of data for this week the calendar is moderate, however expect earnings to drive the news and grab everyone’s attention. Here are some of the highlights:

Monday – US PMI, Australia Central Bank Governor Speech, Earnings from Apple and United Health Services; Tuesday – UK GDP, US Consumer Confidence, US Home Price Indices, Earnings from Ford, BP, Merck, Pfizer, and Twitter; Wednesday – Swiss Consumption Indicator, Euro-zone Economic Bulletin, German Consumer Price Index, US GDP, US Personal Consumption, US Pending Home Sales, US Fed Interest Rate Decision, New Zealand Interest Rate Decision, Japan Industrial Production, Earnings from Hess, MasterCard, Yelp, and Baidu; Thursday – Bank of Japan Interest Rate Statement, German Unemployment, Euro-zone Consumer Price Index, US Weekly Jobless Claims, Japan CPI, Japan Unemployment, Earnings from ExxonMobil, Royal Dutch Shell, ConocoPhillips, Visa, AIG, LinkedIn, and Cigna; Friday – UK Consumer Credit, UK Manufacturing PMI, Canada Manufacturing PMI, US Manufacturing PMI, US Construction Spending, Earnings from Chevron, Clorox, and Duke Energy.

This week the range of possible prices for popular ETFs is:

| ETF Ranges for Week Ending May 1, 2015 | |||

| Ticker | Ticker Name | Lower Range | Upper Range |

| SPY | S&P 500 ETF | $207.90 | $215.50 |

| QQQ | NASDAQ-100 ETF | $108.40 | $113.10 |

| IWM | Russel 2000 ETF | $122.90 | $128.70 |

| TLT | 20+ Year US Treasury ETF | $126.60 | $131.60 |

| USO | US Oil ETF | $18.80 | $20.10 |

| GLD | Gold ETF | $110.40 | $116.10 |

With talk and data from both bears and bulls supporting their respective causes it is easy to get caught up in either side of the argument. Keeping a broad perspective helps put your trades in context. However, you must always be mindful that it is your capital at risk. Remember the only analysis or predictions are the ones that are right for your particular trading style.

Good luck and trade rationally.