With the earnings season coming to a close, it seems like the financial world is on a holiday. The funny thing is that the developments during this time will likely drive markets for the rest of the year. So ’tis the season for planning…

Charts Courtesy of Yahoo Finance.

With the bulk of earnings reports for the last quarter already out, the attention should be turning to the decline of the Chinese economy, lower energy commodity prices, and the expectation of higher US interest rates. The recent narrative has been about the Chinese government devaluing its Yuan currency in order to boost their ability to export goods and with that their economy. Such a large and drastic move is sending chills down investors spines with the thought of the second largest economy in a slowdown.

With energy consumer China in a slowdown, a rally in energy prices is less likely to happen before the dust settles. Also various economies will feel the wake of the Chinese currency devaluation.

Countries that export to China will suffer since their goods will be less expensive and will likely have an initial reduced demand as a result. Other exporting economies that were vying to compete with China have also been hit as now their exports are suddenly more expensive than China’s.

This move affects a number of global and developing economies. All in the backdrop of the United States facing its first rate increase in almost a decade. The rise in interest rates (which makes US Government Securities cheaper) will open the door to a larger pool of investors who would probably have settled for bonds with much less credit quality at the same prices. So when an investor had to choose between an emerging market bond and a US bond, it was easy to compare the credit risk versus the cheapness of the bond. Now that discount for lack of credit quality is not so great. Don’t get too carried away, the credit quality difference has always been priced in, its just that more investors will see value in US bonds, perhaps widening the gap between the debt of the US and other emerging and Asian-Pacific markets.

This makes the US Fed meeting minutes a focal point this week. Traders will be looking for signs of either imminent rate increases or perhaps a sign of caution. Remember that one of the reasons for increasing rates is to keep inflation in check. The Fed could make an arguement that depressed oil prices and a slowdown in the next biggest economy are signs of a lack of inflation. The Fed, now more than ever, is sensitive to the global economic environment. Even if employment in the US is stabilizing, the Fed may wait longer to raise rates.

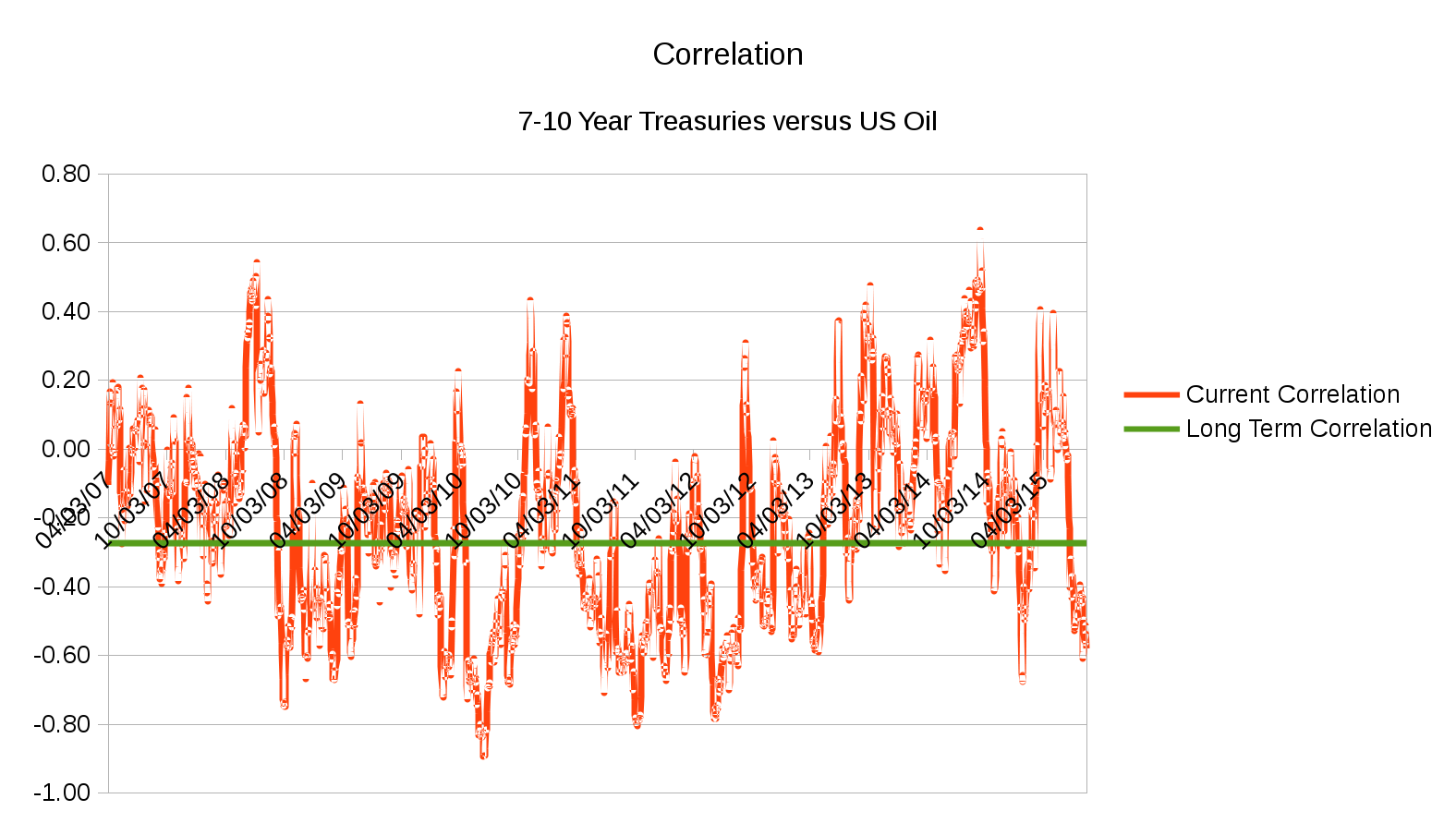

So a major topic of investigation might be how US interest rates, US Oil, and the US Dollar strength might relate to each other. As all trading ideas built on relations, simpler is better. Let’s look at two different ways you may express a trade idea.

First, the 7-10 year US treasury ETF, IEF, versus the US Oil ETF, USO. We see that there is a long term correlation of around -0.27. While this is not the strongest of relationships, it does matter. It tells us that when IEF goes up, USO tends to go down, and vice versa. Currently we are far from this long term relationship. We are currently experience a stronger than usual relationship. What might be next? The relationship cannot get too much stronger, so maybe the coupling becomes less predictable in the future.

So while there is still room for the reciprocal relationship to strengthen, there is more room for the relationship to get weaker and then unidirectional.

So while there is still room for the reciprocal relationship to strengthen, there is more room for the relationship to get weaker and then unidirectional.

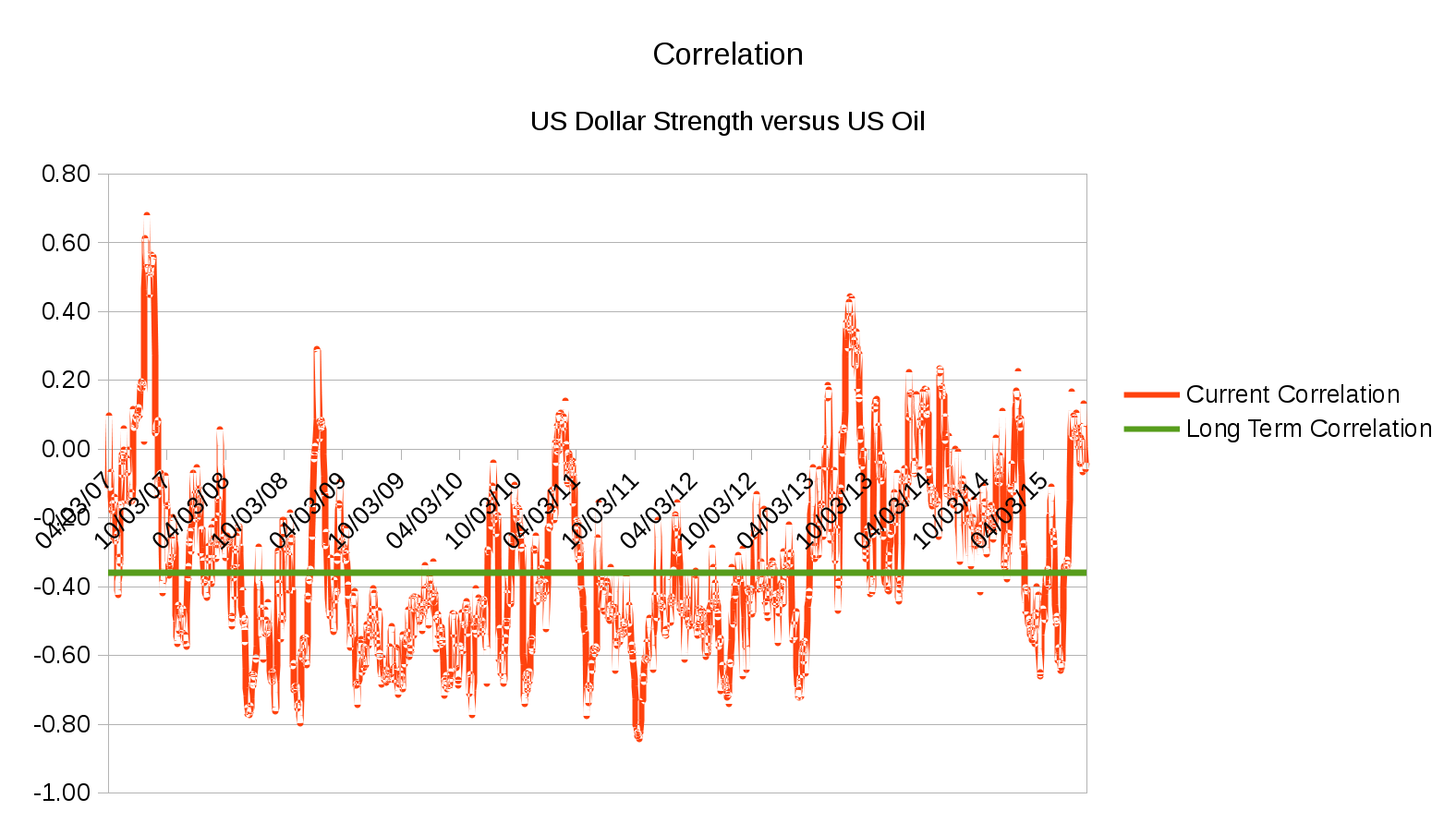

The relationship between US Oil and the US Dollar strength as measured by the ETF UUP is in a situation where there currently very little relationship between the two ETFs.

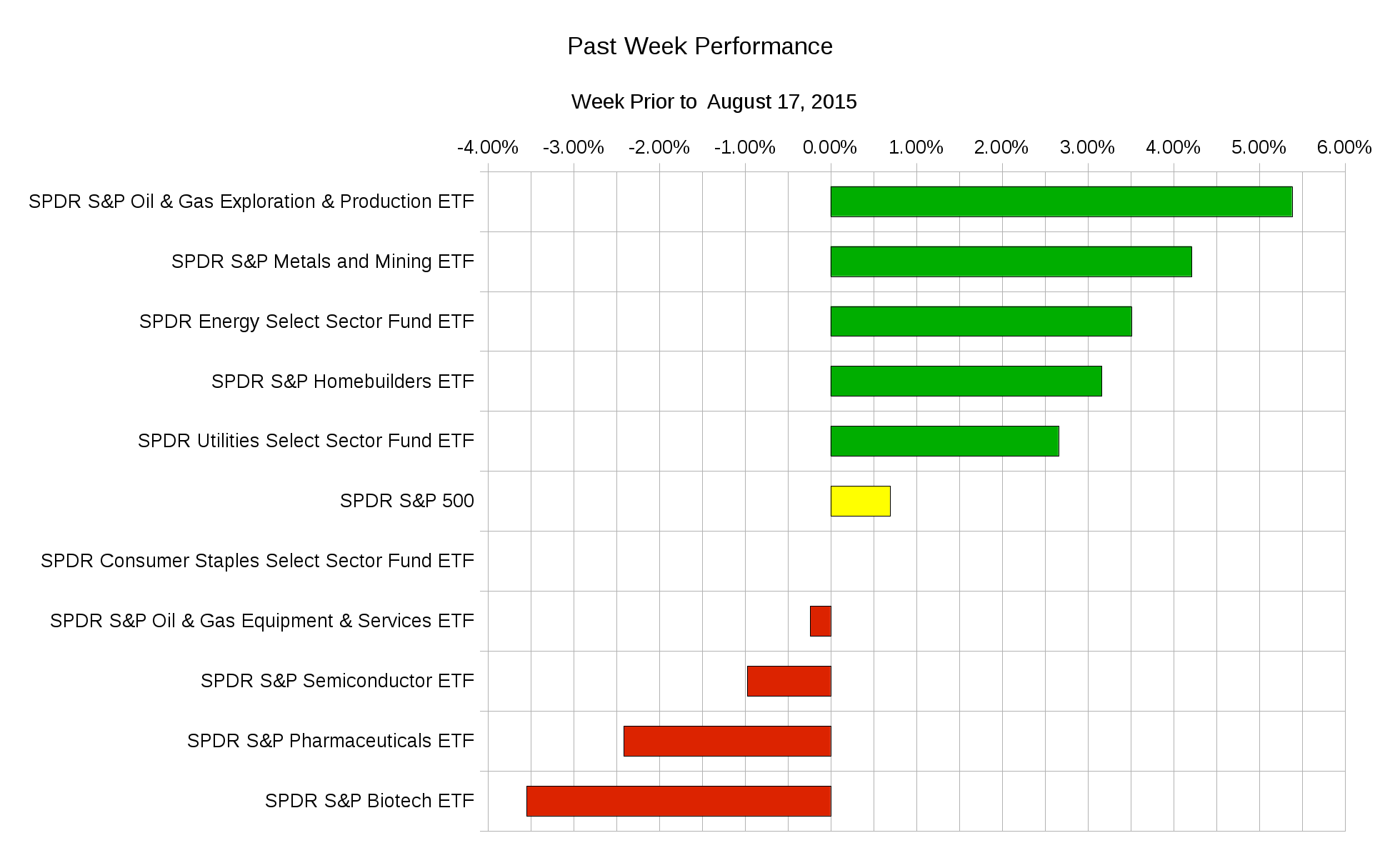

The past week performance in the S&P 500 saw some interesting action in commodity based sectors. Energy, energy production, and metals and mining saw some buying. Perhaps traders feel like the Chinese devaluation will help reboot their industries and China will increase its energy demands. On the other hand, usual stalwarts of the market such as biotech and pharmaceuticals were shunned.

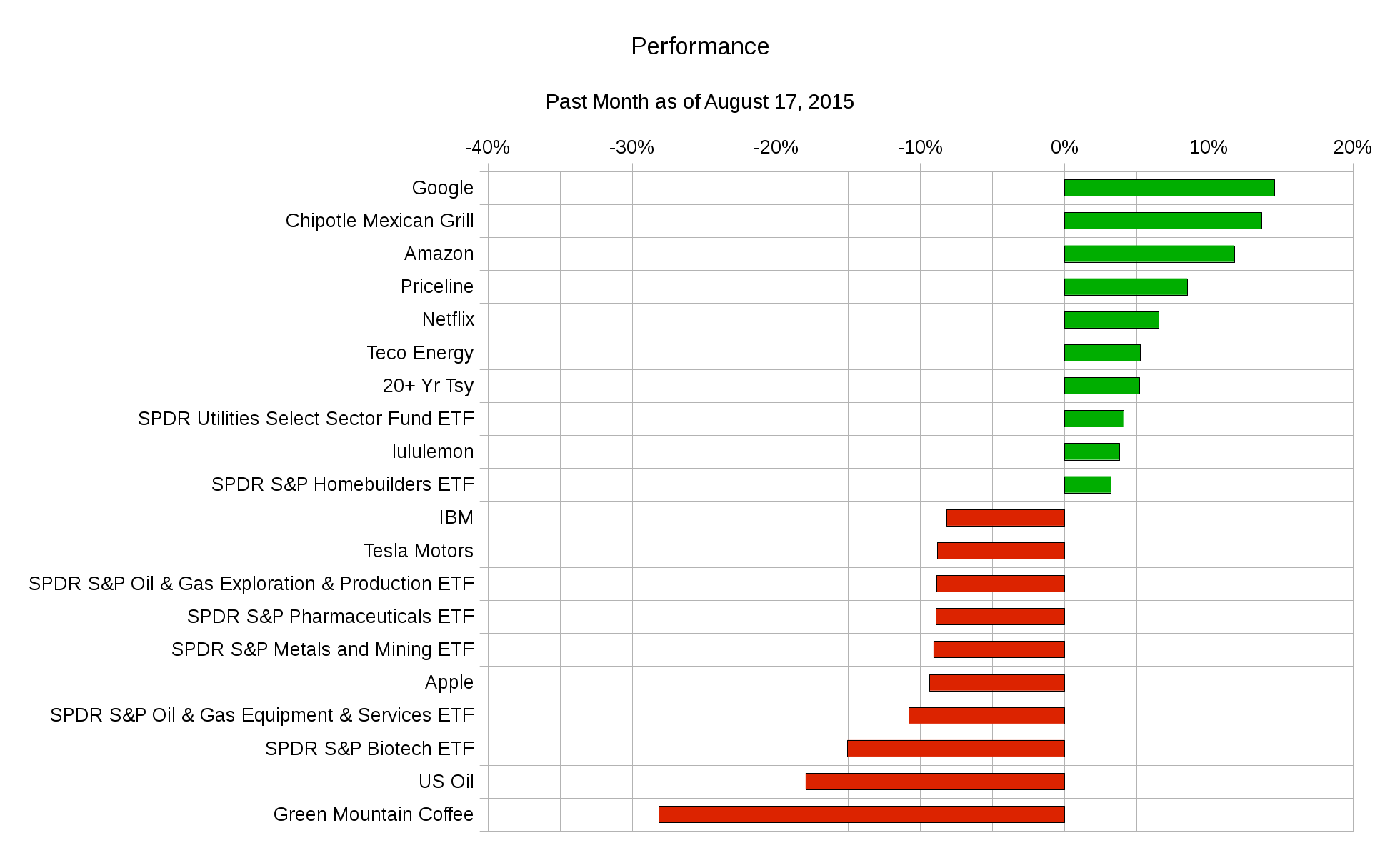

In a broader range of asset classes, we see the aftermath of earnings on some popular names dominating the action.

In a broader range of asset classes, we see the aftermath of earnings on some popular names dominating the action.

While the Greek debt crisis got all the attention earlier in the summer, these current dynamics are more important and likely to provide the undertone of the market for the next month or so. It would be irresponsible to warn of a market direction up or down, it is more important to see what kind of volatility and liquidity environment will take shape. Liquidity is a measure of how fluid the market is in transacting. For example, are bids and offers readily accepted and have a narrow gap? If so then price action is easier to follow and flows more smoothly. If not then the action is choppy with more surprising jumps in prices. This could make or break certain trading strategies.

The week in economic data is as follows:

Monday – Swiss Retail Sales, US Housing Market Index; Tuesday – Australian Central Bank Meeting Minutes, UK Consumer Price Index, US Housing Starts, Japan Exports and Imports; Wednesday – US Consumer Price Index, US Fed Meeting Minutes; Thursday – Japan Central Bank Rate Decision; Friday – Canada Consumer Price Index.

The ranges for some popular ETFs this week are:

| ETF Ranges for Week Ending August 21, 2015 | |||

| Ticker | Ticker Name | Lower Range | Upper Range |

| SPY | S&P 500 ETF | $206.10 | $213.30 |

| QQQ | NASDAQ-100 ETF | $108.30 | $113.00 |

| IWM | Russel 2000 ETF | $117.70 | $123.20 |

| TLT | 20+ Year US Treasury ETF | $121.50 | $126.60 |

| USO | US Oil ETF | $13.40 | $14.40 |

| GLD | Gold ETF | $103.90 | $109.30 |

Remember to pay attention to the dynamics and overall tone of the market. Regardless of the direction of the market you may hope for, the important thing is the market action that makes it possible for you to enter and exit your trades easily.

Good luck and trade rationally.