With much of the latest round of news headlines out of the way we are marching on through a new round of earnings reports. Will the market rally help keep equities positive for 2015 throughout the summer?

Charts Courtesy of Yahoo Finance.

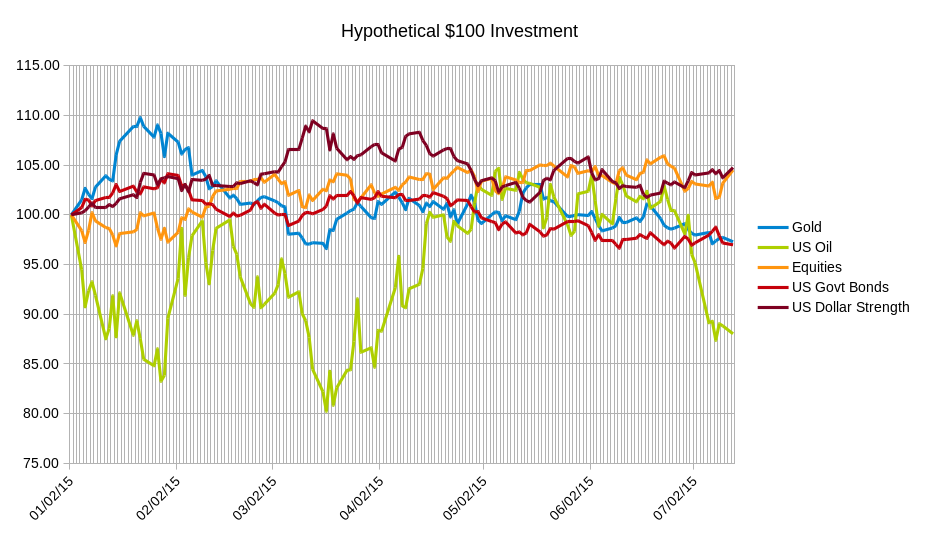

After news of a compromise in the Greek debt situation that led to a pause of talk about a Greek exit from the Euro, markets have rebounded and seem content with the current financial climate. So far the year has been challenging for every asset class except the US Dollar and equities. All other major asset classes are having a negative year.

With the recent uptick in equities, the focus has turned to earnings reports of major companies. With markets continuously pushing all time highs, questions about a bubble or a top always seem to creep in.

With the recent uptick in equities, the focus has turned to earnings reports of major companies. With markets continuously pushing all time highs, questions about a bubble or a top always seem to creep in.

What is more important is not to get too scared about which direction the market is headed. You risk ignoring current and consistent trends.

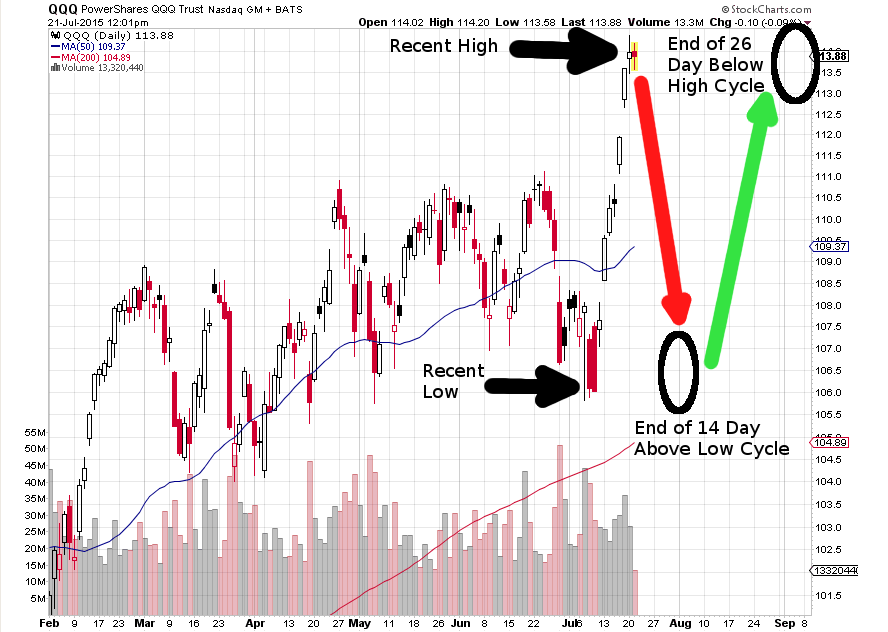

The Nasdaq ETF, QQQ, usually spends 26 trading days below recent highs once selling begins. It also spends about 14 trading days above recent lows once buying begins. In the current cycle of the Nasdaq QQQ ETF we are at day 7 of a cycle that on average lasts 14 days. Rather than think about whether or not the peak has been hit it is more prudent to think about the next opportunity to participate in the market. This may mean another buying opportunity at the recent low may not occur until 7 more days from now. If you buy now you might have to wait 26 days for your purchase to regain the recent highs. That would bring you to the end of August and beginning of September. Here is a graphic that summarizes this:

This manner of thinking assumes that the average event occurs. Of course that is only one of an infinite amount of possible paths the market may take. The purpose of this exercise is to keep a time perspective on trading. Sometimes your strategy may be independent of time. Meaning that you intend to tie up capital until a certain gain or loss is achieved. Time may weigh in on your decision to stick with a potentially dead money trade or to revisit your investment thesis to see if the conditions you are looking for are still valid. If you are playing the market with options then time is essential to your strategy and you should be aware of statistics like the ones presented here.

This manner of thinking assumes that the average event occurs. Of course that is only one of an infinite amount of possible paths the market may take. The purpose of this exercise is to keep a time perspective on trading. Sometimes your strategy may be independent of time. Meaning that you intend to tie up capital until a certain gain or loss is achieved. Time may weigh in on your decision to stick with a potentially dead money trade or to revisit your investment thesis to see if the conditions you are looking for are still valid. If you are playing the market with options then time is essential to your strategy and you should be aware of statistics like the ones presented here.

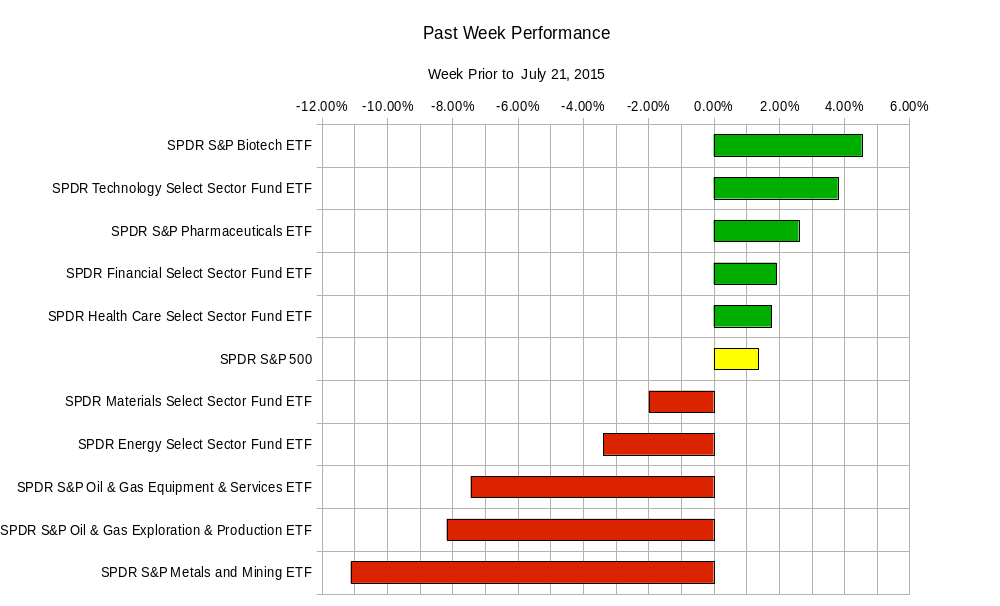

Going back to a more recent time frame here is the way the different sectors of the S&P 500 performed this week.

The broad markets have shown us that there has been some strong buying in the names coming up with earnings reports.

The broad markets have shown us that there has been some strong buying in the names coming up with earnings reports.

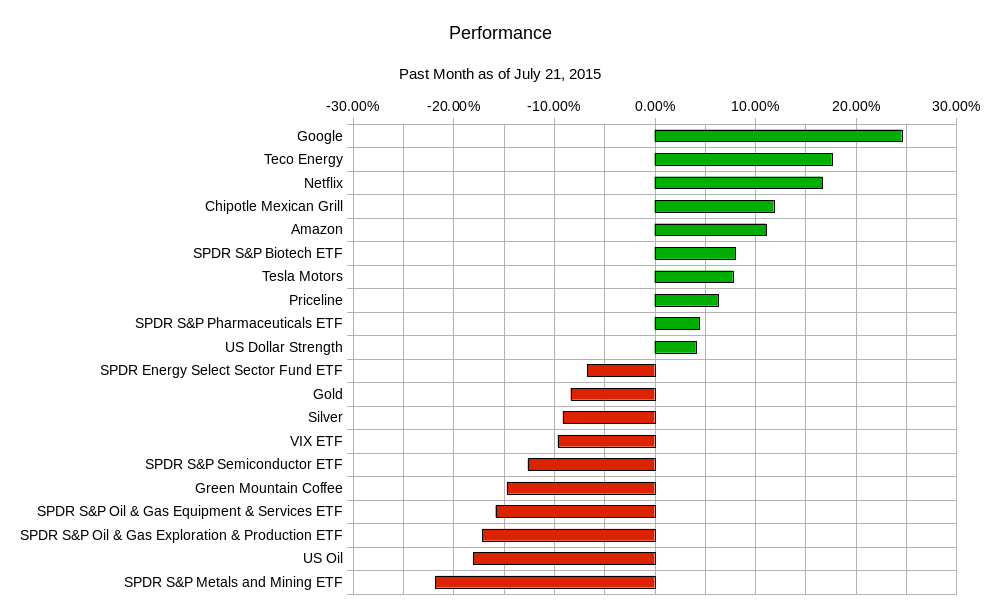

The rest of the week will be focused on some of those technology heavyweights seen above. Other economic data is light:

The rest of the week will be focused on some of those technology heavyweights seen above. Other economic data is light:

Tuesday – Earnings from Apple, Microsoft, Yahoo, Chipotle, United Technologies; Wednesday – Australian Consumer Price Index, UK Bank of England Rate Policy Vote Results, UK Inflation report, US Housing Market Index, US PMI, New Zealand Interest Rate and Monetary Policy Decision, Japan Foreign Bond and Stock investment and earnings from Boeing, Qualcomm, Coca-Cola ; Thursday – Canadian Retail Sales and earnings from General Motors, AT&T, and Visa, Amazon, McDonald’s, Starbucks ; Friday – German Manufacturing PMI, Eurozone PMI, US New Home Sales, and earnings from Biogen, Abbvie, and V.F. Corporation.

Popular ETF Ranges will be:

| ETF Ranges for Week Ending July 24, 2015 | |||

| Ticker | Ticker Name | Lower Range | Upper Range |

| SPY | S&P 500 ETF | $208.90 | $215.50 |

| QQQ | NASDAQ-100 ETF | $111.70 | $115.90 |

| IWM | Russel 2000 ETF | $121.90 | $127.20 |

| TLT | 20+ Year US Treasury ETF | $116.00 | $120.40 |

| USO | US Oil ETF | $16.40 | $17.50 |

| GLD | Gold ETF | $104.00 | $108.50 |

Remember whether or not time is on your side or you do not care about time, it is important to keep active. Recognize that time is one of the important signals in the markets that tends to get overlooked.

Good luck and trade rationally