The Greek referendum brought a “No” and the world has not ended, so what is next?

Charts Courtesy of Yahoo Finance.

Besides oil, most asset classes have failed to continue the trends they were showing in the overnight markets Sunday into Monday morning during the voting in Greece. Once markets started opening in Europe and then the United States things started to quell. The Greek referendum has many interesting facets to it and it could lead to many different debates and market forecasts.

What is important in a time like this is to remain calm and disciplined. With all the dynamics that seem possible it is tempting to develop a trading strategy to capitalize on some perceived volatility. Some trading strategies will prove to be unique opportunities while others will be complete flops. This is where discipline comes in. It is not a bad thing to come up with a plan and devise a forecast where equities drop 5% or gold increases 5% and then build a complex option strategy to reflect that. Or you can simply surmise that those movements are likely and buy and sell the market at appropriate prices. The key to success, which should also mean a lack of failure, is keeping extreme speculation trades to a small amount of disposable capital. In this scenario disposable means you would not blink if you lost that amount instantaneously.

In summary, the Greek public voted against austerity changes that would affect pensions, retirement ages, and other social services. The austerity measures were a condition of a bailout package that provided the country with enough cash to meet its debt obligations. If the European Central Bank does not receive its debt payments from Greece, the ECB may force Greek banks to return deposits to consumers. In short, the government will have to hand out an “I owe you”, IOUs to pay workers and pensioners. This would most likely lead to a second currency being developed and an eventual Greek departure from the Euro currency.

Besides the unfortunate collapse of the Greek banking system, a systematic widespread banking crisis will be contained. Stress will certainly be felt in the markets. The main cause of concern would be whether or not a larger economy starts to mimic the Greece crisis. It shows that the Euro’s design had some holes to prevent such a situation.

What is interesting is to take a look back at how the markets performed whenever Greece was in the headlines. Although exercises in history are not always predictors of future cycles, it is always a good idea to try and keep things in perspective. That’s important because recent history probably goes against your intuition.

Below is a table that compares the weeks where the number of times that Greece is a search topic on Google is above average and the performance of some various ETFs. The performance, measured by total return and daily volatility over the week is then compared to the typical performance during any week.

| Ticker | Name | Weekly Return During Focus | Average Weekly Return | Daily Volatility Over Focus Week | Daily Volatility Over Any Week |

| gld | Gold | -0.01% | 0.21% | 1.04% | 1.27% |

| qqq | Nasdaq | 0.37% | 0.18% | 1.06% | 1.87% |

| spy | S&P 500 | 0.33% | 0.20% | 1.00% | 1.19% |

| uso | US Oil | 0.10% | -0.16% | 1.96% | 2.12% |

| ief | 7-10 Year US Treasuries | 0.06% | 0.11% | 0.43% | 0.44% |

| iwm | Russell 2000 | 0.55% | 0.21% | 1.34% | 1.56% |

| shv | Short Term US Treasuries | 0.00% | 0.02% | 0.01% | 0.03% |

| dia | Dow Jones Industrial Average | 0.29% | 0.17% | 0.94% | 1.21% |

| tlt | 20 Yr + US Treasuries | 0.02% | 0.15% | 1.03% | 0.88% |

| uup | US Dollar Strength | 0.05% | 0.01% | 0.55% | 0.58% |

What we have here is a sign that even though Greece has dominated news headlines and has probably sparked many ideas in trader’s minds, it has lead to indifference from market prices. Overall, the returns during the weeks where Greece has been a hot topic on google are close to the weekly returns during all times.

Furthermore, the daily volatility during those weeks is actually less than the daily volatility during all weeks. This means that brilliant idea of buying all sort of far out of the money options is probably not that brilliant unless it is a tiny proportion of your overall capital allocation. In this case tiny should be 0.10%.

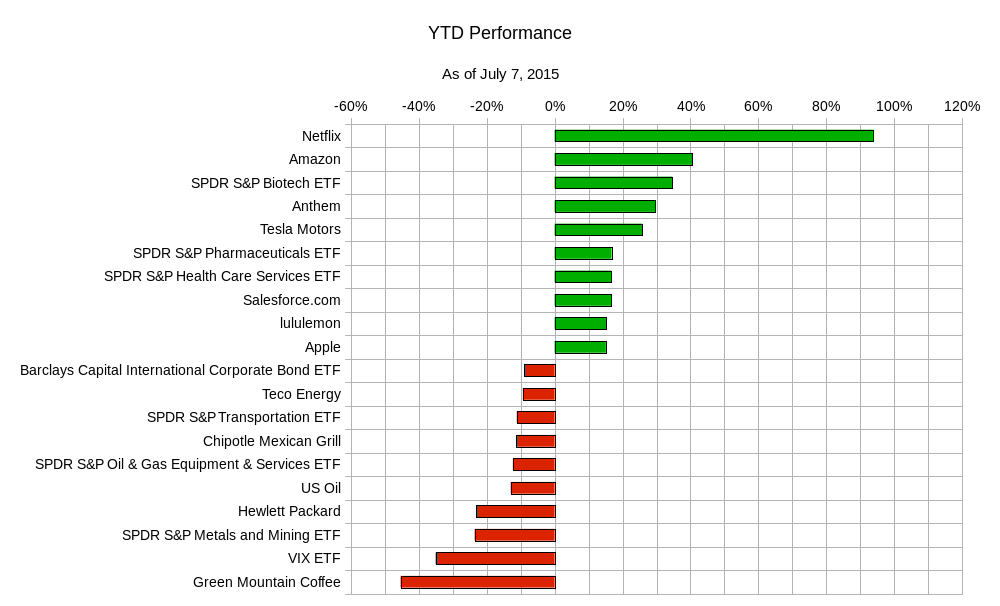

So how has the broader market performed over the first half of the trading year? Let’s look at the top long positions and the best short positions.

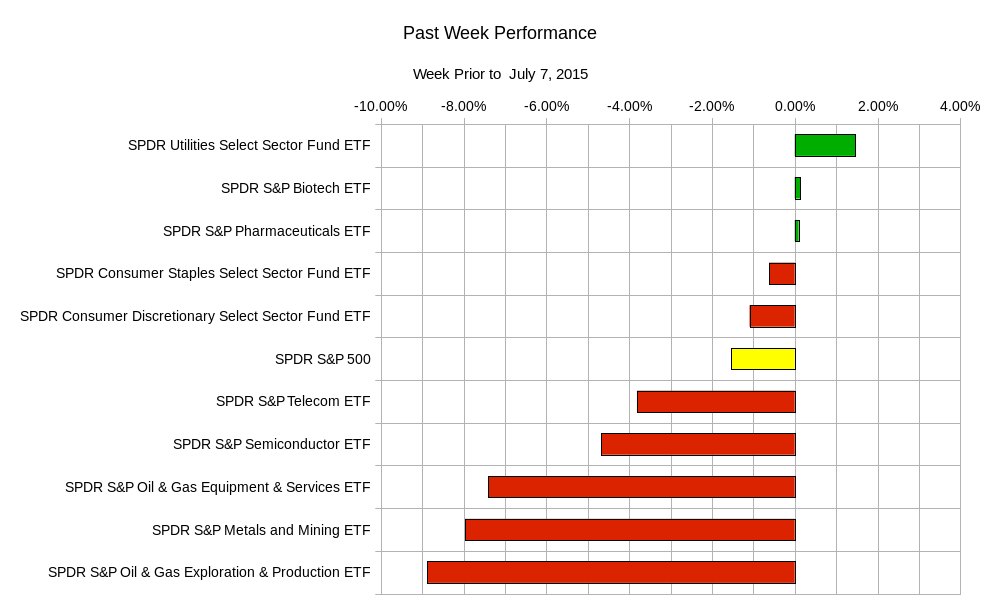

A deeper look into the past week for the different sectors of the S&P 500 shows the following sector rotation:

A deeper look into the past week for the different sectors of the S&P 500 shows the following sector rotation:

It seems that investors were sure they wanted out of equities except for utilities, biotech, and pharmaceuticals. Those three sectors were stars during the early part of 2015 and perhaps investors are placing capital in companies that they think will do well. However, notice that relatively more money was removed from the red sectors than in green ones. This is a sign of investing smaller amounts in uncertain times. Investors are probably gearing up for the next earning seasons. The upcoming earning seasons may determine whether the year for equities is a positive or negative one.

It seems that investors were sure they wanted out of equities except for utilities, biotech, and pharmaceuticals. Those three sectors were stars during the early part of 2015 and perhaps investors are placing capital in companies that they think will do well. However, notice that relatively more money was removed from the red sectors than in green ones. This is a sign of investing smaller amounts in uncertain times. Investors are probably gearing up for the next earning seasons. The upcoming earning seasons may determine whether the year for equities is a positive or negative one.

For the rest of the week the economic data will be:

Tuesday – Eurogroup meeting, UK GDP estimate, EU leaders special summit; Wednesday – EU Extraordinary Economic Summit, UK Budget report, US FOMC minutes, US Consumer Credit, Japanese Foreign Bond Investment, Japanese Foreign Investment in Stocks; Thursday – UK Bank of England Asset Purchase Facility adjustment, UK Bank of England Interest Rate Decision, Canadian Housing Starts, US Weekly Initial Jobless Claims.; Friday – Australian Home loans, Canadian Unemployment Report.

The ranges for the most popular ETFs are:

| ETF Ranges for Week Ending July 10, 2015 | |||

| Ticker | Ticker Name | Lower Range | Upper Range |

| SPY | S&P 500 ETF | $203.70 | $210.10 |

| QQQ | NASDAQ-100 ETF | $105.50 | $109.40 |

| IWM | Russel 2000 ETF | $121.00 | $126.20 |

| TLT | 20+ Year US Treasury ETF | $117.40 | $121.90 |

| USO | US Oil ETF | $16.90 | $18.00 |

| GLD | Gold ETF | $108.60 | $113.50 |

Remember that getting wrapped in the emotion of news reports and breaking stories will only distract you from what the numbers game is really telling you. If you are going to try and take advantage of a speculative situation be prepared to lose it all. That should be enough to make it clear that pure speculation based on noise and media hysteria are lottery tickets at best.

Good luck and trade rationally.