Markets approached all time highs and have fallen short. The lack of a deal in Greece regarding its IMF payment, US Fed policy weighing in, and the notion that June is usually a slow month have traders in a holding pattern. With most asset classes having subdued performances up or down, being prepared for the next move may make or break the year for a lot of investors.

Charts Courtesy of Yahoo Finance.

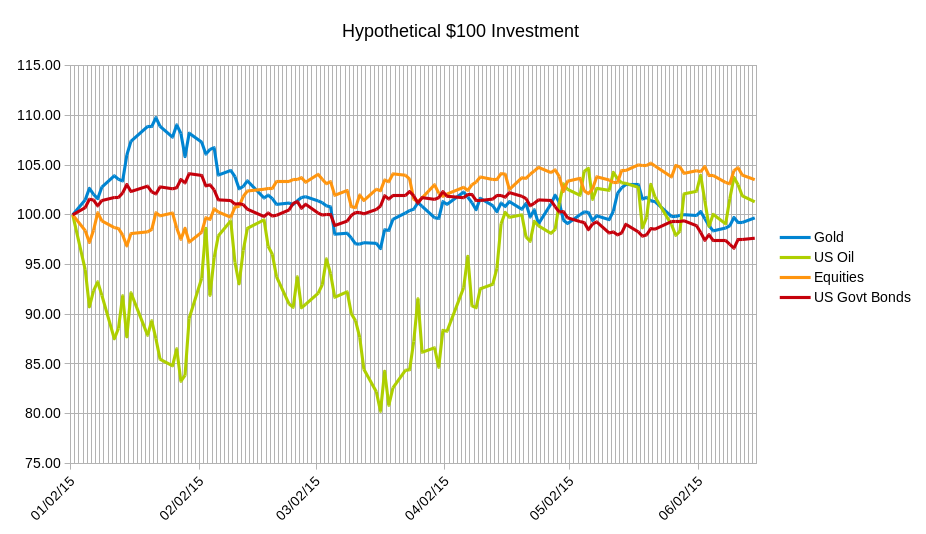

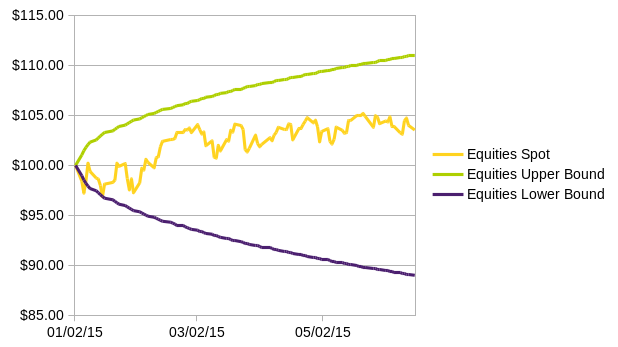

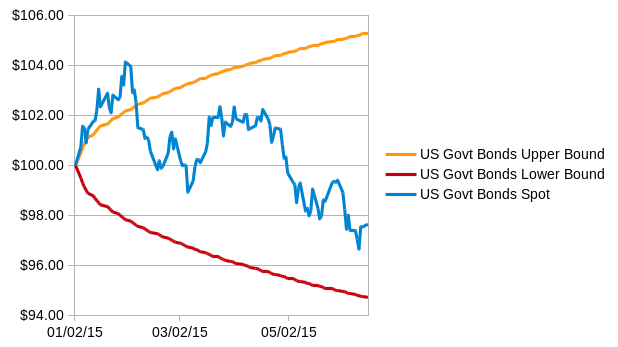

Surprisingly for the year many asset classes are reverting towards their starting prices this year. If we look at the year to date performance for some major asset classes we see that despite some initial large moves things have stayed relatively quiet the past few months.

Looking at each of those asset classes we see that they are all well within the range of a typical performance so far.

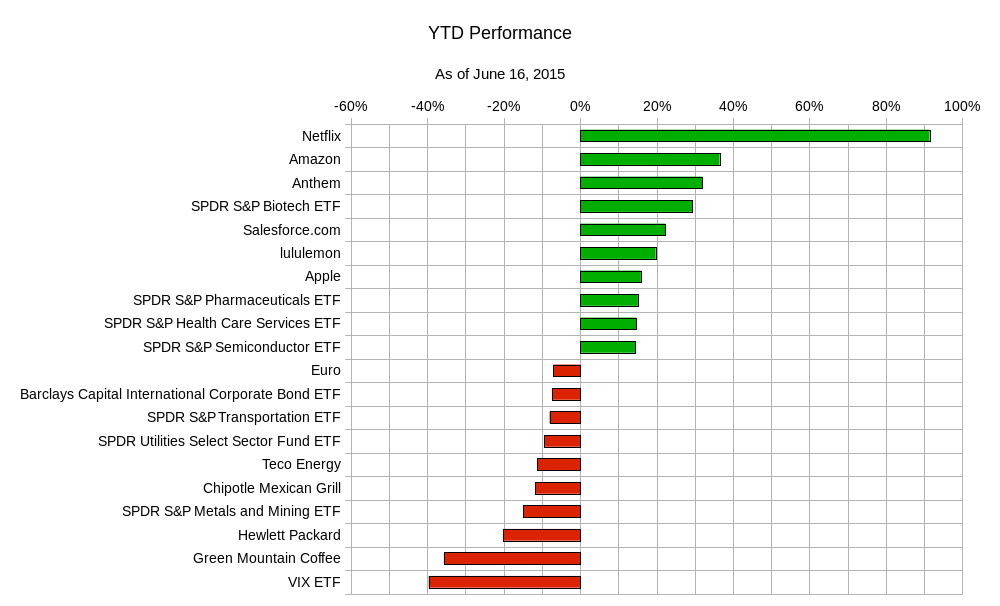

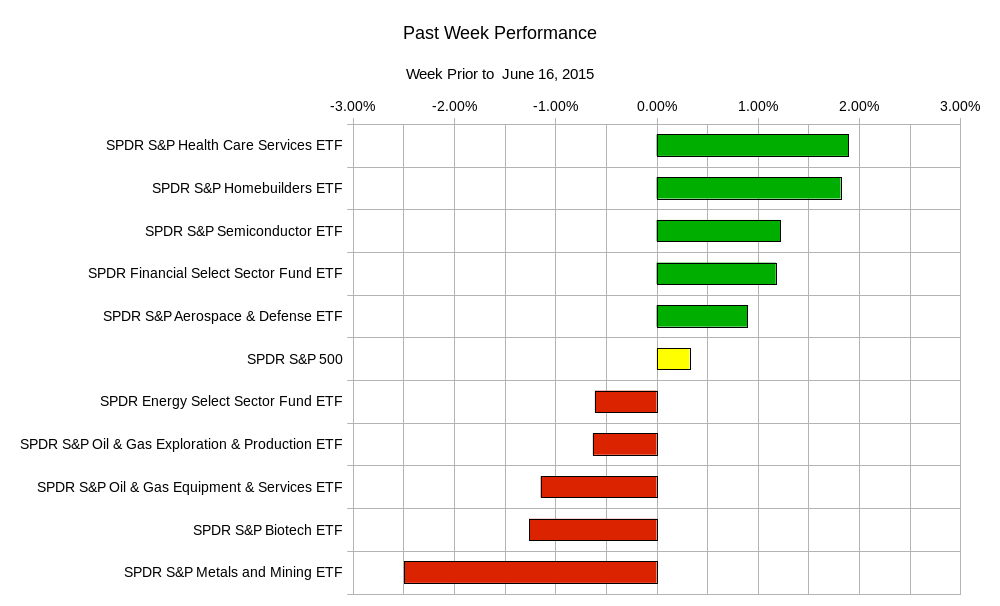

The real stories are in the details. If you look at the year to date performance of a broader range of asset classes you see the following results:

The real stories are in the details. If you look at the year to date performance of a broader range of asset classes you see the following results:

Netflix has had an amazing run. While still one of the top performers of the year, the biotech sector has seen more cooling down as of recent weeks. This trend continued last week. The market also had some active sector rotations during this time.

This shows a short term trend of stock picking and sector preferences. This may mean some weakness or range bound trading in the indices. This would of course change if there were some major event. However, if the trend continues, paying attention to individual stocks or other asset classes will be the key to success. This will mean that making broad market directional guesses will lead to frustration for many. This week will have some data that will likely be overshadowed by central bank decisions and policy statements. Expect news or lack thereof from Greece to at least grab headlines. Though none of the major stakeholders in the Greek debt negotiations should be surprised, it may take away any willingness for traders to put on heavy positions. Here is a summary of some of the week’s data:

This week will have some data that will likely be overshadowed by central bank decisions and policy statements. Expect news or lack thereof from Greece to at least grab headlines. Though none of the major stakeholders in the Greek debt negotiations should be surprised, it may take away any willingness for traders to put on heavy positions. Here is a summary of some of the week’s data:

Tuesday – US Housing Starts, US Building Permits; Wednesday – UK Bank of England MPC Rate Vote, Eurozone Consumer Price Index, US Fed Interest Rate Decision and Monetary Policy Statement; Thursday – Swiss National Bank Interest Rate Decision, Eurozone – ECB Long Term Refi Amount, US Weekly Jobless Claims, US Consumer Price Index; Friday – Japan Monetary Policy Statement, Canadian Consumer Price Index, Canadian Retail Sales.

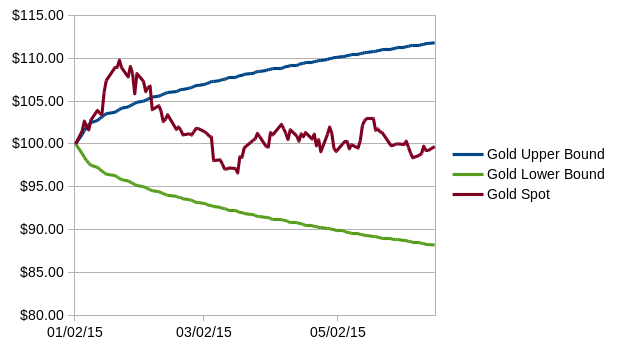

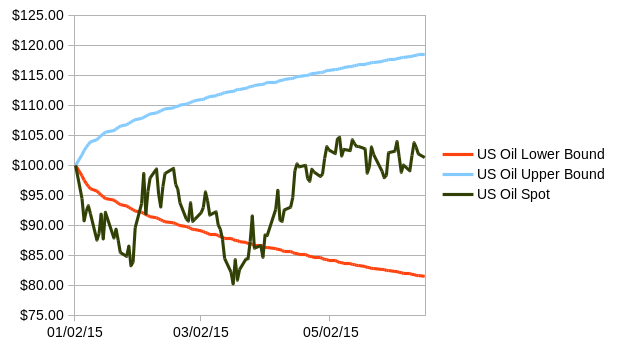

This week the ranges of possible prices for popular ETfs are:

| ETF Ranges for Week Ending June 19, 2015 | |||

| Ticker | Ticker Name | Lower Range | Upper Range |

| SPY | S&P 500 ETF | $207.30 | $213.70 |

| QQQ | NASDAQ-100 ETF | $107.00 | $110.90 |

| IWM | Russel 2000 ETF | $123.80 | $129.10 |

| TLT | 20+ Year US Treasury ETF | $116.80 | $121.20 |

| USO | US Oil ETF | $19.60 | $20.90 |

| GLD | Gold ETF | $110.80 | $115.80 |

When the market makes it so that you cannot just buy or sell a broad index, you need to broaden your horizon. Just because a broad index is not fitting your trading strategy doesn’t mean something else won’t. You just may have to dig deeper to find that needle in the haystack. A market that has lulled a lot of investors and traders to sleep like this is dangerous. Those who have been frustrated with their trading performance due to the lack of volatility may start to take on more risk than appropriate to try and “make up” for lost time. That only magnifies mistakes in your trading discipline.

Good luck and trade rationally.