With economic data giving mixed signals could the next big move be no move?

Recent earnings have shown unexpected growth this past quarter, however the US housing market might be signalling a slow down in spending. Mergers and acquisitions are a sign of spending, but what happens when the merger is between dollar value stores in the US? With the US monthly unemployment report out due this Friday, perhaps we are in for ride to nowhere.

Last week was marred by Amazon’s beat on revenues but disappointing earnings report. That coupled with a sharp decline in new home sales in the US led to an immediate drop in equity prices that never recovered until this past Monday. Now with the positive GDP number from the US let’s see if equities can close the week higher or even near all time highs.

The rest of the week will certainly have data to try and move the market. Wednesday – US Fed Interest Rate Decision, Asset Purchase Program Adjustment, and meeting minutes; Thursday – German Unemployment Rate, Eurozone Consumer Price Index, US Weekly Jobless Claims; Friday – US Employment Report, US Personal Income and Outlays, ISM Manufacturing Index.

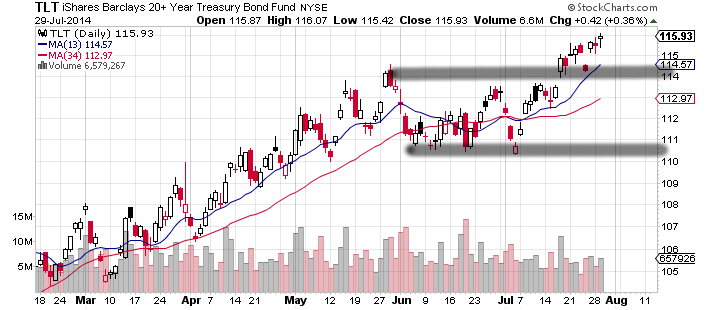

In terms of price levels for the rest of the week the SPY, S&P 500 ETF, might land between 195.20 and 199.60. The gold ETF, GLD, might end up between 123.00 and 126.80. Interest rates by way of the TLT 20 year+ ETF could end the week between 114.40 and 117.40.

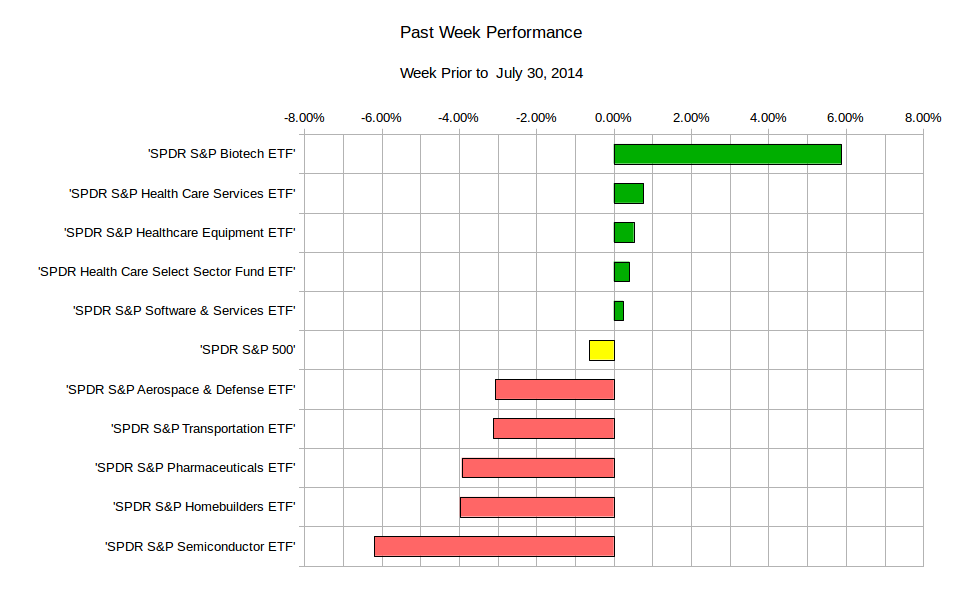

In terms of the the past week’s sector rotation the strong push in the biotechnology sector seems to indicate there is no slow down in risk appetite.

The real action may be in interest rates as US FOMC policy will be in focus with some important US economic bellwether data points being released this week. Despite the strength of the equity markets, interest rates have kept up pace. Part of this may be attributed to spikes in geopolitical pressures. However, these reasons don’t explain the trend. It is the spikes that are helping to maintain it. If we examine the TLT, 20 Years and later US Government Bond ETF we see a recent breakout out of a trading range. It is quite possible that this range may form a near term support for the ETF. It appears that in the immediate future there may be some indecision around the 114 and 110.50 price levels. The indecision may act like a support for the recent rise in this ETF.

Chart Courtesy of StockCharts.com

While the summer is moving along slowly, at some point real volatility may return. This is a time to look at different asset classes to see if your investment hypotheses are being played in a different market. If you are bearish in the equity market, perhaps the bond market is where that sentiment is being rewarded. If you have an opinion on commodities or interest rates, perhaps it is time to take a close look at currencies. Profit from the time spent analyzing instead of waiting for monetary profits.

Good luck and trade rationally.