After a busy week of economic data and central bank announcements the equity market continued its bullish tone and charged to new highs. Will there be profit taking to give new investors a chance at joining the party or will the market keep you on the edge of your seat like a World Cup game?

Equities had been trading sideways in the beginning of last week in anticipation of the US Federal Open Market Committee announcement on its rate policy. Markets were rewarded with news that fit its expectations. The Fed Chair Janet Yellen announced the, as expected, continued tapering of its asset purchasing program, affirming investor’s belief that the US economy continues to recover. Furthermore, traders were given signs of hope that increases in short term interest rates were not in the immediate future.

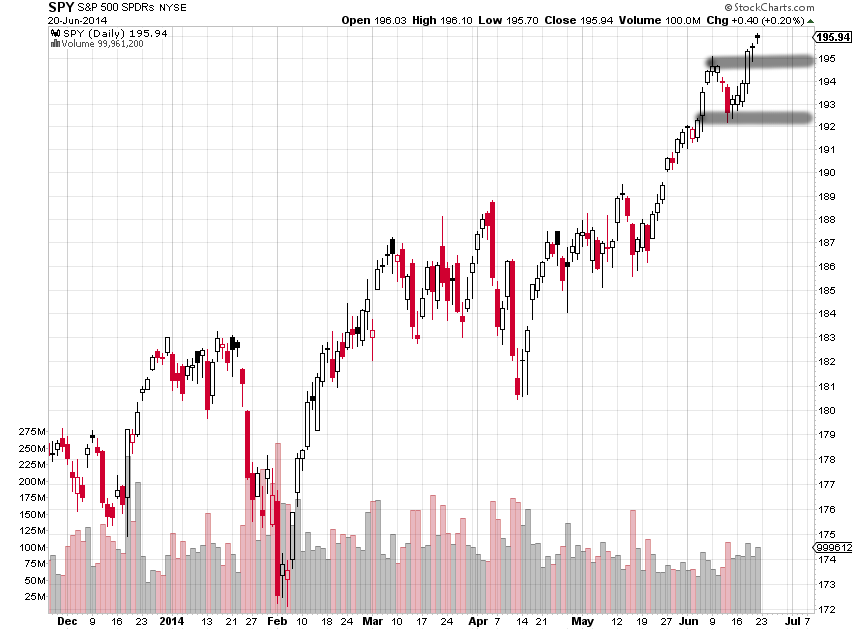

After the announcement equities made their strongest move of the week to the upside. After hitting the highs on Thursday, some profit taking took place. So far the profit taking was mild and typical of recent price action.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

What this might mean for the immediate future is that short term supports will likely hold. In this situation a value like 192.50 may for a near term support. The SPY, S&P 500 ETF, is above in uncharted territory. It seems unwise to be short without any tight controls on positions at these levels. The SPY recovered all of its recent losses and has broken out above the 195 resistance recently formed.

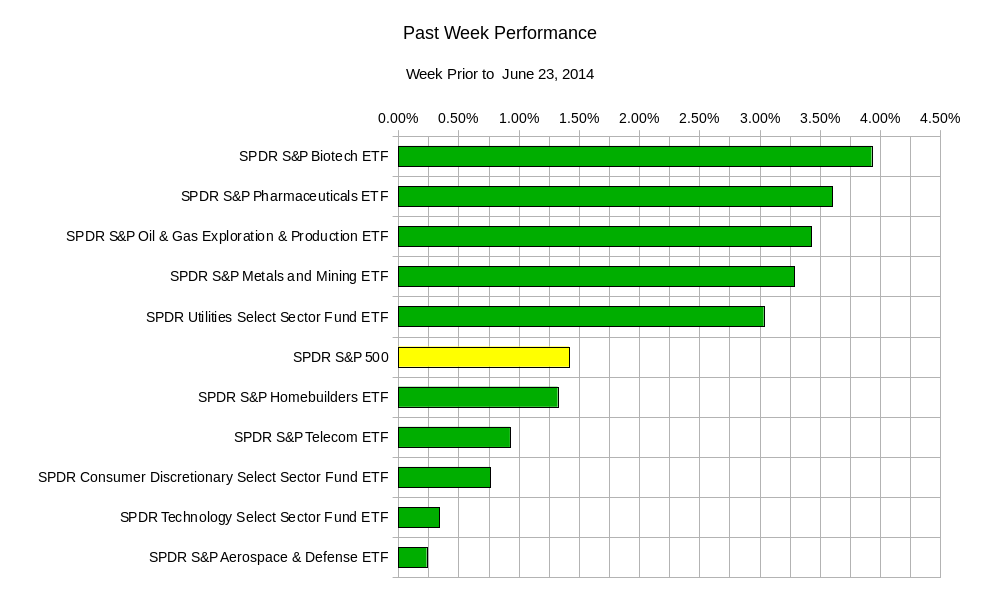

In terms of the sector performance. It was nearly impossible to lose money if you were long.

With action like this it is very easy to become complacent.

With action like this it is very easy to become complacent.

The SPY , S&P 500 ETF is likely to end somewhere between 192.20 and 198.90 this week.

The economic data this week is as follows:

Monday – Euro-zone PMI, US Manufacturing PMI, and US Existing Home Sales; Tuesday – UK Inflation Report and US New Home sales; Wednesday – US GDP and US Durable Goods Orders; Thursday – Japan CPI, UK Bank of England Governor’s Speech, and US Weekly Jobless Claims; Friday – UK GDP.

A “quiet” equity market like the one we have experienced in recent weeks can often surprise traders. Often a larger move to either counter the current trend or support it is already in the works. It may just seem hidden. In retrospect it will seem obvious but now it is easy to miss. This market may seem easy to profit from, but the profits from low volatility conditions are usually smaller and can easily be wiped out when the surprise hits. It is prudent to think of your trade’s profitability probability. If your trades are making money do not let greed set in. Take profits quickly. Take care not to forget that you are beating the odds and that at some point things could reverse. Once you have beaten the odds, closing out trades might be the prudent thing to do.

Good luck and trade rationally.