After beginning the month of June at all time highs, the equity market continued to march on to even higher ground. Despite the continued wave of market optimism, the market broke its streak of weekly gains. Will new developments like the violence in Iraq dampen the mood? Or will bold mergers and acquisitions put the bull run back on track?

Two weeks ago the expected rate cut by the European Central Bank woke up an otherwise dormant market. The ECB acted as it said it would by enacting short term interest rate policies intended to buoy the Euro-zone economy. The table was then set up for the US monthly employment report. The report was rather unremarkable as most of the data points came in as expected. The report did nothing to sway the needle on the US economic situation barometer. This helped stocks continue their push higher the following week. Finally after four weeks of gains S&P 500 futures finally relented to some profit taking and closed on a down note.

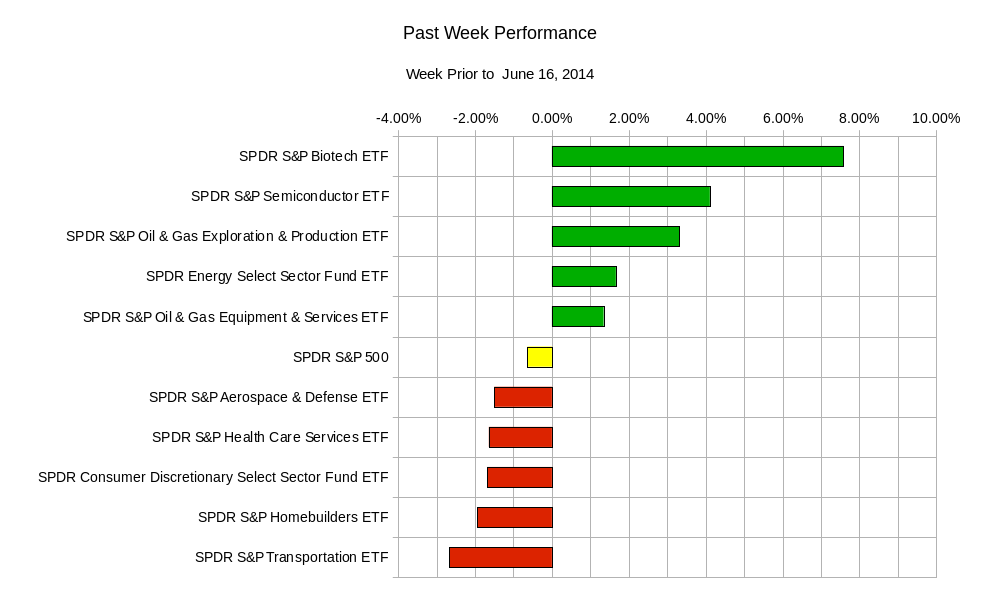

In terms of sector performance we see an actual rotation in sectors as opposed to the unilateral buying of all sectors of recent weeks.

Two competing dynamics came to rise late last week. First a new wave of violence in Iraq where a strong insurgent movement has overtaken numerous cities in northern Iraq. The militant activity has sparked concerns over sectarian violence. The violence has caused speculators to drive the price of oil up significantly. However, the general equity market has not followed the pattern it established when the Ukraine crisis began. In that case equities typically sold off sharply into the weekend as traders were concerned that negative events over the weekend could punish investors who were long. This past Friday equity markets rallied into the weekend, softening the blow from the prior days trading session.

In contrast, there has been two major acquisitions, which are usually made when corporate leadership believes there are economic opportunities worth taking advantage of. This type of activity means that people may have a more positive outlook on the future of the economic situation. The first acquisition announced was that of Priceline.com paying USD$2.6 Billion, a 53% premium, for online restaurant reservation service OpenTable. The merger mania continued as US medical device maker Medtronic purchased Irish based surgical device maker Covidien for USD$42.9 Billion, a 29% premium. Certainly deals of this size are not made unless management feels comfortable with the current economic outlook.

Charts Courtesy of Yahoo Finance

The market is also set for a busy week in terms of economic data releases.

Monday – Euro-zone Consumer Price Index (CPI) and US Industrial Production ; Tuesday – UK CPI, US CPI, Bank of Japan Monetary Policy Minutes; Wednesday – Bank of England Minutes, UK Monetary Policy Committee Rate decision, US FOMC Interest Rate Decision, and US FOMC Bond Buying Program Adjustment; Thursday – US weekly Initial Jobless Claims and US Philadelphia Fed Survey; Friday – Canadian CPI and Futures Quadruple Witching.

By the end of the week the SPY, S&P 500 ETF, could land between $190.20 and $197.80; GLD, the Gold ETF, could land between $119.70 and $125.80; USO, the oil ETF, could end in between $38.00 and $40.40.

Be aware of the increased liquidity driven by news events. Liquidity can be defined by the willingness of traders to buy or sell to others. Even if a market seems lopsided it may still be a liquid market. It can continue that way until traders decide to take profits. This may have nothing to do with the news events. But rest assured the news will be used as an opportunity to get trades done in a short time that would normally have taken longer periods of time to get done. Be careful not to be the last one holding a hot potato.

Good luck and trade rationally.