Last week saw a lot of choppiness in the market with a bearish tone in the market. The S&P 500 rallies were mostly met with selling. The news of the emerging market outflows continued to dominate the headlines. Underwhelming earnings and guidance from some important companies did not help either. However the rallies did show that there were interested buyers. They just did not get any instant gratification and are being forced to sweat. Now onto this week.

This week will bring another week of earnings reports and some light economic data until Wednesday’s ADP US employment report and then the all important US monthly employment report. This report should get some extra attention due to the recent fear that has crept into the market. A bad report can mean that the fears concerned with emerging markets and China will be joined by questions about the US recovery. That cannot go well. A good report will probably cement the US equity market as the preferred choice of working capital and give a boost to the equity market. Again we will probably see a range bound market until the big Friday employment report. Even if the market settles down after the employment reports, there may be enough price action to get in or out of trades. You just have to be ready to take advantage.

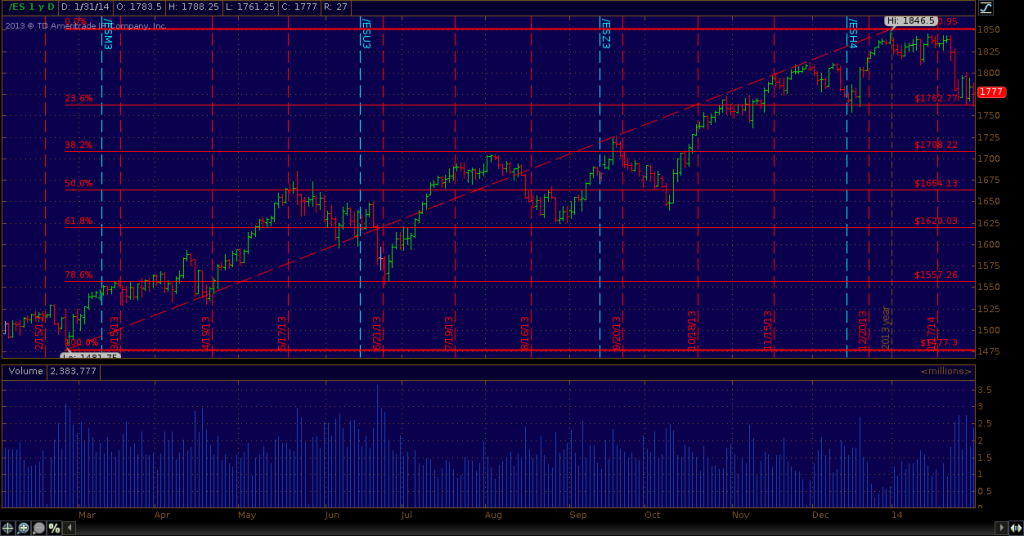

The S&P futures are in precocious area if you like to look to charts. The prices seem to be poised for something to happen and either continue in it’s upward trend or fall off a cliff. Just like last week the S&P 500 needs to break out of this clustering of prices and gain momentum above 1806. However, the 1730 level is lurking below.

Chart Courtesy of Thinkorswim by TDAmeritrade

Chart Courtesy of Thinkorswim by TDAmeritrade

For the SPY traders an average week should see the range of $174.30 and $181.90.

In the interest rate world:

US treasuries are having a decent year so far despite the FOMC reducing it’s bond purchasing program and stating that economic activity picked up in recent quarters. Treasury bonds are benefiting from the market jitters. The decline in the 10 year treasury futures has leveled off and seems to be in an upward trend.

Chart Courtesy of Thinkorswim by TDAmeritrade

Chart Courtesy of Thinkorswim by TDAmeritrade

Like equity futures, expect US Treasuries to respond on Friday morning to the jobs report. If you trade the ten year futures you are probably looking at ending the week between 124-20/32 and 127-01/32.

Constantly update the assumptions you used for your trades. Do your trades still make sense?

Good luck and trade rationally.